An objective breakdown of what Centersquare offers — where it shines, where it may be less suitable — plus alternatives and our standard Off-List CTA.

Size & Locations — The Scope of Centersquare

- Centersquare was formed in 2024 via the merger of Evoque Data Center Solutions and Cyxtera Technologies. (Dallas Innovates)

- As of late 2026, Centersquare claims a network of ~80 data-center facilities across North America and the U.K. (datacentremagazine.com)

- The footprint covers major U.S. and Canadian metros, including (but not limited to) Silicon Valley (Santa Clara / Sunnyvale), Dallas/Fort Worth, Northern Virginia / Ashburn, Chicago area (suburban & downtown), New York/New Jersey (Weehawken, Secaucus, Piscataway), Boston, Los Angeles/Irvine, Phoenix/Mesa, Tampa, Denver, Seattle, and several others. (Datacenters.com)

- Overall infrastructure stats include 3.5 million+ sq. ft. of data-center space and 400+ MW of power capacity across the portfolio. (centersquaredc.com)

Bottom line: Centersquare is a large, geographically diverse colocation operator — with broad coverage across U.S., Canada, and parts of the U.K. — capable of supporting both regional and multi-region infrastructure needs.

Pros & Cons — What Works (and What to Watch Out For)

👍 Pros

- Large & mature footprint with many data centers: With ~80 facilities spanning many major markets, Centersquare offers flexibility for clients needing colocation across different geographies (North America + UK).

- High power & space capacity — 400+ MW and millions of square feet of data-center space give room for high-density, large-scale, or hybrid workloads.

- Flexible colocation offerings: From single cabinets to large cages — suitable for small deployments, enterprise-scale, or anything in between.

- Enterprise-grade redundancy, security & compliance: Many sites offer redundant power/cooling configurations (N+1, 2N), carrier-neutral connectivity, and compliance with typical data-center standards (SOC, ISO, PCI, etc.), tailored to enterprise & regulated-industry needs.

- Ready for high-density and next-gen workloads (including AI/ML demand): Following a recent $1 billion acquisition of 10 data centers in 2026, Centersquare explicitly positions itself to meet surging demand for high-performance, high-density infrastructure.

- Strong focus on customer service and “hybrid-IT readiness”: Their stated mission emphasizes reliability, proactive customer support, and flexible solutions for hybrid-cloud / on-prem + colo environments.

👎 Cons / Limitations

- Relative youth of the merged entity — growing pains possible: As a newly rebranded and consolidated company (2024 merge), organizational maturity across all sites may still be evolving.

- Coverage still heavily U.S. / North America-centred: While they have some presence in the U.K., their strongest footprint remains U.S./North America — less suited if you need wide global (e.g. Asia, Middle East, Africa) presence.

- Possible variability across sites: Given the number of facilities and rapid expansion via acquisitions, performance, services, and maturity may vary from site to site.

- Premium features and enterprise-grade setup may come at higher cost compared to small/regional colos: For smaller workloads or startups, simpler/smaller providers might be more cost-efficient.

- Competition & consolidation in the market — uncertainty in long-term pricing or SLAs as demand surges: Rapid acquisitions and industry shifts (especially with AI demand) may lead to supply pressure, which could affect pricing or availability.

What Clients & Market Observers Say

- Recent industry coverage highlights Centersquare as a “rising star” in the data-center sector — especially after its 2026 expansion aimed at supporting AI and high-density enterprise workloads.

- Observers note that Centersquare combines the “scale and redundancy of a large operator” with flexible colocation offerings — making it attractive for enterprise clients seeking to migrate off-premises infrastructure without building their own data centers.

- For companies needing a balance of power, connectivity, flexible footprint, and enterprise-class compliance, Centersquare often competes well against legacy colocation providers and hyperscale operators.

Overall sentiment: Centersquare is emerging as a mid-to-large colocation leader — strong for enterprise-scale, high-density, hybrid workloads — with growing recognition as a go-to provider for modern digital infrastructure demand.

Pricing Tier — High / Medium / Low (Estimation)

Compare Top 20 US Colocation Providers

“Hi, I’m Bob Spiegel, founder of QuoteColo.com and author of this comparison. I’ve spent 20+ years as a broker in the colocation industry, working with nearly every major US provider, hundreds worldwide, and countless regional operators. I know who delivers real value and who’s just good at marketing.

If you want pricing and a curated shortlist of providers matched to your needs (location, power, budget), message me. With access to 500+ US providers, I can save you time and money.

Enjoy the list.”

Estimated Tier: MEDIUM → HIGH

Given its scale, power density, broad geographic spread, enterprise-grade compliance and readiness for high-density workloads (including AI, high-performance compute, cloud migration), Centersquare likely commands pricing above basic/regional colocation providers.

For clients needing only minimal resources or small-scale deployments, it might be more cost-effective to use smaller/regional providers. For larger or mission-critical workloads, however, the value-to-cost ratio tends to be solid.

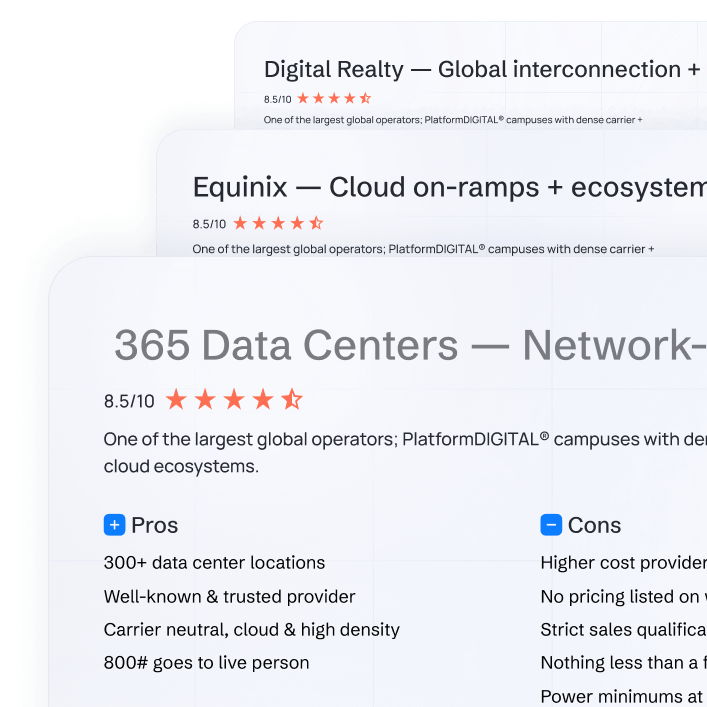

Alternative Providers to Centersquare (2026-Forward)

If you’re evaluating Centersquare but want to compare different tradeoffs (cost, global reach, specialization, flexibility), consider:

- Equinix — global colocation/interconnection giant, excellent for worldwide presence, dense connectivity, and hybrid-cloud strategies.

- Digital Realty — global data-center REIT with broad international footprint and strong enterprise-grade facilities, ideal for multi-region deployments.

- CyrusOne — U.S.-focused colocation provider, often more cost-competitive than large operators, good for regional or national-scale deployments.

- Iron Mountain Data Centers — attractive for clients prioritizing compliance, security, and regulated-industry readiness (e.g. finance, healthcare).

- Smaller / regional colocation providers — for lean, low-cost, or local deployments where global reach and massive power capacity aren’t required.

- Off-list / private-market data-center operators (via QuoteColo network) — for bespoke infrastructure needs, niche compliance needs, or highly customized hosting arrangements outside mainstream providers.

When Centersquare Makes Sense — and When to Consider Alternatives

Choose Centersquare if you:

- Need colocation across multiple U.S. regions (or North America + U.K.) and want flexibility in location selection.

- Run high-density workloads, enterprise-scale infrastructure, or expect growth (cloud migration, hybrid clouds, AI/ML workloads).

- Value enterprise-grade redundancy, compliance, connectivity, and power/space capacity.

- Prefer a single vendor that can flex from small cabinets up to large cages / high-density deployments.

- Want a provider that combines modern infrastructure with a growing footprint and expansion momentum.

Consider alternatives if you:

- Operate small-scale workloads or just need minimal hosting — cheaper, regional providers may offer better price efficiency.

- Need global presence beyond North America / U.K. (e.g. Asia, Middle East) — other global providers may have better reach.

- Need highly bespoke, edge, or specialized infrastructure setups where smaller or niche providers may be more agile.

- Want flexibility or minimal vendor-lock-in, especially in a volatile market with many acquisitions.

QuoteColo Off-List / Matchmaking CTA

Compare Top 20 US Colocation Providers

We’ve brokered colocation for 20+ years across 500+ US providers.

Get an objective comparison to find real value on power, uptime, and connectivity.

View the Comparison

If Centersquare seems too large, too powerful, or too enterprise-grade for your needs — or even if it looks like a good fit, but you’d like to explore more options — QuoteColo’s private network remains at your disposal:

- We maintain a database of 500+ vetted colocation and hosting providers — from global operators to regional and private-market data centers.

- We offer free, no-obligation matchmaking: you share your requirements (region, power, density, budget, compliance needs) → we deliver tailored provider quotes — often including off-list facilities that don’t appear publicly.

- Custom / bespoke deployment options — for users needing flexible terms, carrier-neutral connectivity, high-density / high power support, specialized compliance agreements, or non-standard physical configurations like private cage/suite or granular 1U / 2U / Half-rack / Full-rack colocation setups, as well as hybrid on-prem + colo deployments and tailored SLAs.

👉 If you like — just give me your hypothetical or real requirements (rack count, power density, region, growth plan) — I’ll run a quick match and pull 4–6 candidate providers from our network for you to evaluate.

Bottom Line — Is Centersquare Right For You?

Centersquare is a serious, modern, and rapidly growing colocation provider — increasingly attractive for organizations needing scalable infrastructure, high-density / high-power capacity, and flexible footprint across North America and the U.K.

If you run enterprise-grade workloads, expect growth, or need hybrid-cloud / high-density compute infrastructure, Centersquare offers a compelling, balanced mix of scale, flexibility, service, and redundancy.

If your needs are small, local, or cost-sensitive — or you require global presence beyond their footprint — you should weigh alternatives or explore off-list providers.