This often includes off-list providers not visible on public price sheets or directories helping you discover options with better cost, flexibility or tailored SLAs.

Size & Locations. The Scope of CoreSite

- CoreSite owns and operates ~30 network-dense, cloud-enabled data centers across 11 strategic U.S. markets, totaling more than 4.5 million square feet of space.

- Their data centers are carrier-neutral and interconnection-rich, supporting extensive cross-connectivity and cloud on-ramps.

- Key markets include major hubs such as Los Angeles, New York (Secaucus), Chicago, Denver, Northern Virginia, Silicon Valley, Miami, Orlando, Atlanta, Boston and Washington D.C.

- CoreSite’s headquarters are in Denver, Colorado, and the platform continues to expand with new facilities like NY3 in Secaucus (completed 2026) and ongoing campus expansions in Denver and Silicon Valley.

Bottom line: CoreSite offers mid-to-large colocation and connectivity infrastructure, focused on U.S. strategic metros with robust connectivity and cloud integration.

Pros & Cons: What Works (and What to Watch Out For)

Pros

Strong interconnection & cloud connectivity

CoreSite facilities enable dense interconnection, extensive cross-connects, and direct public cloud on-ramps, making them ideal for hybrid and cloud-connected workloads.

Network-dense presence in key U.S. metros

Presence in major data-center ecosystems enables low latency and broad reach across edge and core markets.

Scalable and modern colocation

CoreSite’s purpose-built campuses serve workloads from small cabinets to high-density deployments, positioning them well for enterprise and emerging compute needs.

Focused on hybrid IT and digital evolution

Their infrastructure is positioned to support hybrid IT strategies, enabling clients to optimize on-prem, colo, and cloud workflows.

Expanding capacity for AI and high-performance use cases

Ongoing campus expansions in Denver and Silicon Valley reflect demand for high-density and AI-ready infrastructure.

Cons / Limitations

U.S.-centric footprint only

CoreSite’s locations are limited to the United States, therefore, global colocation or multi-continent deployments may require alternative providers.

Pricing often mid-to-premium

Network density and cloud-integration features typically place CoreSite’s offerings above basic regional colocation in cost.

Carrier ecosystem varies by market

While major metro hubs provide rich connectivity, secondary or new markets often have lower interconnection density compared to established global carrier hotels.

May be overkill for very simple needs

For small, single-site, low-density workloads, simpler or regional providers may offer better cost efficiency.

What Clients & Market Observers Say

- Independent reviews highlight CoreSite’s strong connectivity, reliable service, and ease of onboarding, while noting that pricing can be higher than smaller regional options.

- Industry coverage underscores CoreSite’s focus on cloud enablement, network density, scalability and hybrid IT readiness, especially as AI and digital transformation demand more flexible colocation infrastructure.

- Completed expansions like NY3 in Secaucus and ongoing development of large campuses signal growing confidence from both customers and the company in meeting future computer needs.

Overall sentiment: CoreSite is regarded as a network-centric, cloud-ready U.S. colocation provider — strong for hybrid cloud, interconnection, enterprise workloads, and emerging AI/compute demands.

Pricing Tier

Estimated Tier: MEDIUM → HIGH

CoreSite typically sits in the medium to higher cost tier due to its focus on:

- Dense interconnection and carrier options

- Cloud on-ramps and hybrid-IT enablement

- Strategic metro locations

- Scalability for enterprise and compute-intensive workloads

For simple, single-location colocation needs, regional or smaller providers often deliver lower cost options.

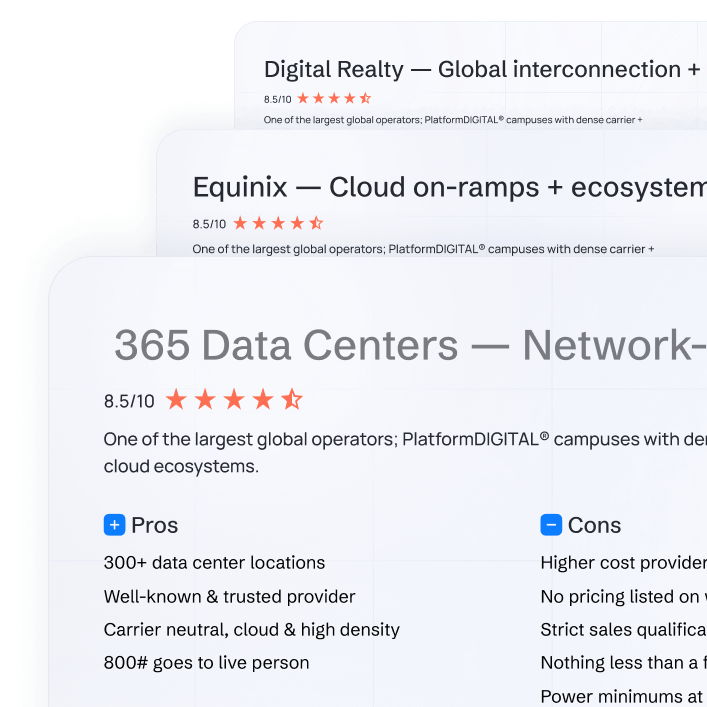

Compare Top 20 US Colocation Providers

“Hi, I’m Bob Spiegel, founder of QuoteColo.com and author of this comparison. I’ve spent 20+ years as a broker in the colocation industry, working with nearly every major US provider, hundreds worldwide, and countless regional operators. I know who delivers real value and who’s just good at marketing.

If you want pricing and a curated shortlist of providers matched to your needs (location, power, budget), message me. With access to 500+ US providers, I can save you time and money.

Enjoy the list.”

Alternative Providers to CoreSite (2026-Forward)

If CoreSite’s offering appeals but you want to explore different trade-offs (global footprint, specialization, pricing), consider:

- Equinix. Leader in global colocation and interconnection with extensive cloud partner ecosystems.

- Digital Realty. Large global REIT-style provider, strong for multi-region enterprise deployments.

- CyrusOne. U.S. colocation provider with competitive pricing and enterprise SLA options.

- DataBank. Broad U.S. footprint with managed services and hybrid IT solutions.

- Regional or local colocation providers. For simple, cost-focused or localized workloads.

- Off-list / private-market operators (via QuoteColo network). For niche, bespoke infrastructure or specialized SLAs not found in mainstream catalogs.

When CoreSite Makes Sense and When to Consider Alternatives

Choose CoreSite if you:

Need strong interconnection and cloud on-ramps between sites and major cloud platforms.

Want network-dense data centers in key U.S. strategic markets

Are building hybrid IT, distributed infrastructure, or multi-site deployments.

Value scalability and support for high-density, compute-intensive workloads (e.g., AI, analytics).

Consider alternatives if you:

Prioritize ultra-dense peering ecosystems in every metro (including international hubs).

Want boutique or hyper-specialized providers tailored to niche requirements.

Require global presence beyond U.S. borders.

Have simple, low-cost, single-site colocation needs.

Compare Top 20 US Colocation Providers

We’ve brokered colocation for 20+ years across 500+ US providers.

Get an objective comparison to find real value on power, uptime, and connectivity.

View the Comparison

QuoteColo Off-List / Matchmaking CTA

Whether CoreSite looks like a strong fit, or even if it almost fits but you’d like more tailored options – QuoteColo can help you get the full picture:

- We maintain a network of 500+ vetted colocation and hosting providers: from global operators to regional and private-market facilities.

- Our free, no-obligation matchmaking service takes your specs (location, power, rack count, cooling, compliance, budget) and delivers customized provider quotes often including off-list options that aren’t widely advertised.

- This means you can compare true market options beyond mainstream catalogs, often finding better pricing, flexibility or SLA terms tailored to your needs.

Just share your deployment details and we’ll return 4–6 tailored providers with pricing tiers and concise service summaries.

Is CoreSite Right For You?

CoreSite stands out as a network-centric, hybrid-IT powerhouse for U.S. colocation and connectivity. If your workloads require dense interconnection, cloud integration, and presence in strategic metro markets, especially for hybrid cloud or future-ready compute, CoreSite is a compelling choice.

For global reach, ultra-cost-sensitive deployments, or highly niche configurations, alternative providers or off-list options may be more suitable.